More Texas corporations filed for bankruptcy during the first six months of 2020 than in any period in the state’s history.

The number of businesses that filed to restructure between Jan. 1 and June 30 in the Southern District of Texas, which includes Houston, more than tripled from a year earlier, according to new data provided exclusively to The Texas Lawbook by Androvett Legal Media research.

In fact, the new data shows that a pair of bankruptcy judges in the Southern District have handled more complex commercial restructurings of large companies than any other federal district in the U.S.

And legal experts predict that just as many companies are likely to declare bankruptcy during the second half of this year because of the COVID-19 pandemic and the historically low oil and gas prices.

“We are still in the early onslaught of this wave,” said Munsch Hardt shareholder Kevin Lippman. “The companies with the tightest liquidity have filed so far.

“The uniqueness about this bankruptcy wave is the breadth of it,” Lippman said. “It is hitting every business sector – energy, retail, hospitality, real estate, airlines. And it is hitting everywhere – it is not isolated to one or two regions of the country.”

The Data

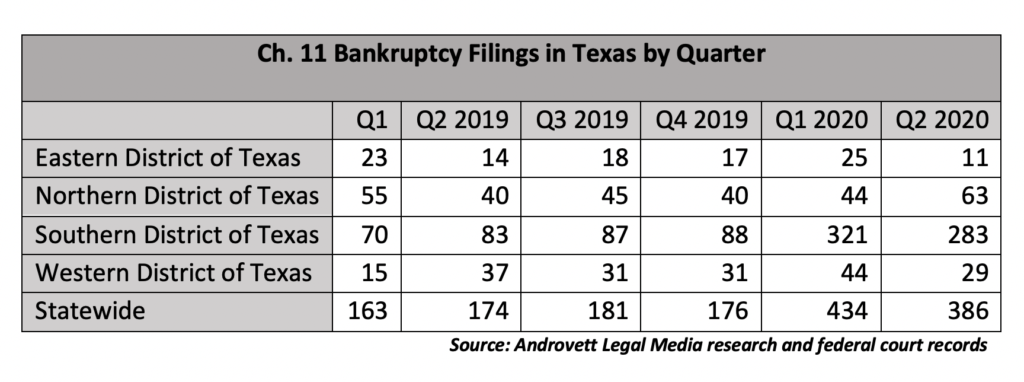

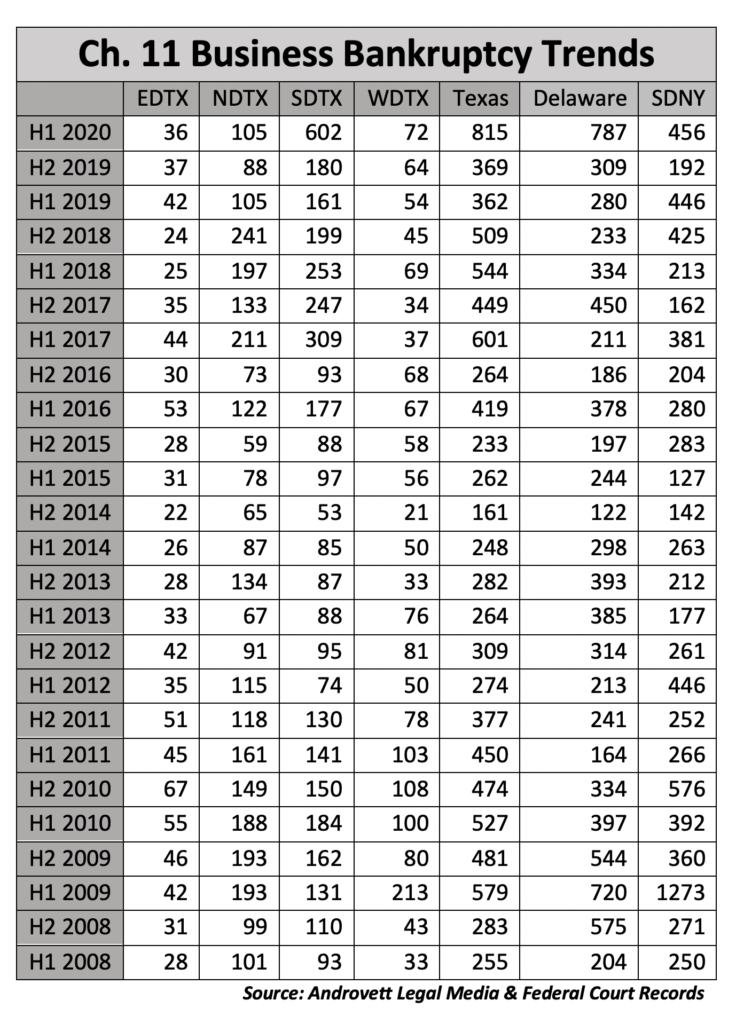

There were 815 companies that filed for bankruptcy protection in the federal courts of Texas during the first half of this year, which is 236 – or 40% – more than did so during the first six months of 2009, which was the heart of the Great Recession, according to the Androvett data.

While all parts of Texas are experiencing economic pain for businesses, no region is being hit harder than Houston.

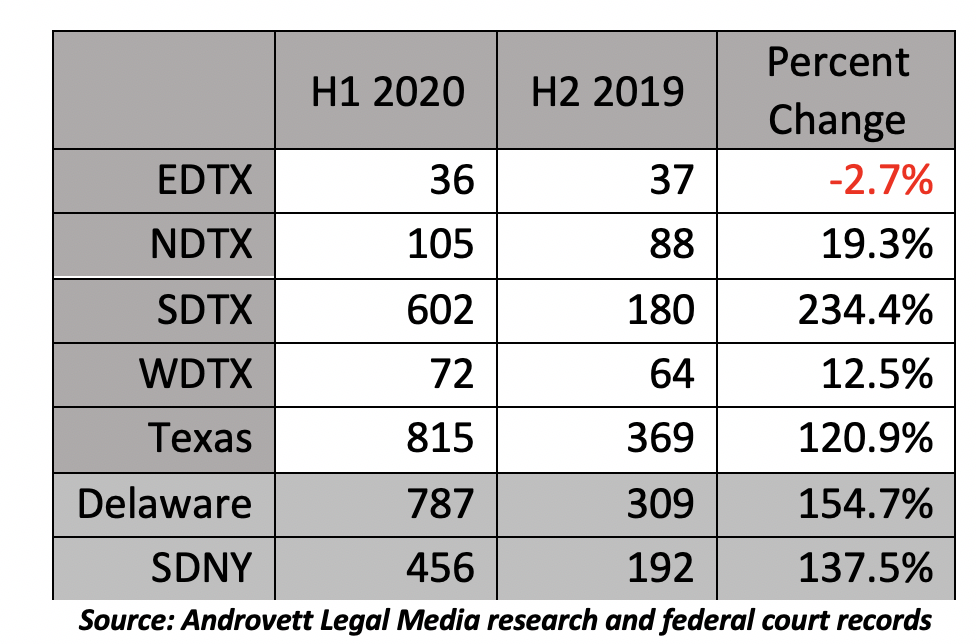

The Androvett data shows that 602 companies filed for protection under Chapter 11 of the U.S. Bankruptcy Code in the Southern District of Texas during H1 2020 – up from 180 during the second half of 2019 or a 234% increase.

By contrast, business bankruptcies in the Western District of Texas, which includes Austin, San Antonio and El Paso, jumped 33% during H1 2020 over the first six months of 2019. Corporate restructurings in the Northern District, which includes Dallas/Fort Worth, witnessed a 19% increase in corporate Chapter 11 filings during the first half of this year versus the final six months of 2019.

“There are still a lot of bankruptcies to be filed,” said Hunton Andrews Kurth bankruptcy partner Tad Davidson. “I think we will see a significant number of Chapter 11s that will be filed for the next 12 to 18 months that are due to COVID-19.”

“On oil and gas upstream, I think we are in the middle of the bankruptcy wave. There are more restructurings in the pipeline,” said Davidson, who is advising Sable Permian Resources in its multibillion-dollar restructuring.

A Second Blitz Coming

Dan Winikka, a partner at Loewinsohn Flegle Deary Simon in Dallas, said bankruptcy courts should expect two separate blitzes of cases.

“We all know there’s still a second wave of smaller-to-midsized business bankruptcies coming,” he said. “Smaller midmarket and midsized companies wait until the last minute to file and the liquidity runway has run out. Sadly, sometimes there’s not much that can be done.”

Lippman and Winikka said that hundreds of commercial real estate companies, especially those that lease to retailers and hospitality providers, are almost certain to need to restructure later this year or early next year.

“The owners of the properties have their own debts to deal with,” Lippman said. “We are going to see a lot more of those in the third and fourth quarters.”

Winikka said the commercial real estate bankruptcies may not be as big-dollar as the energy or retail cases, but they can be very complex.

“For REITS (Real Estate Investment Trusts), it depends on how they are structured,” he said. “Many have multiple layers of debt. Those who hold the most junior debt will get hit the hardest.”

But the mega-cases get the attention.

From Ultra Petroleum and Chesapeake Energy to Neiman Marcus and J.C. Penny, more than two dozen corporations citing debts of $500 million or more have filed in the Southern District of Texas.

Southern District Chief Judge David Jones said SDTX has more complex corporate restructurings of $300 million or more than any other federal district in the nation.

“The goal was never to be busier than other districts,” Chief Judge Jones told The Texas Lawbook in an exclusive interview. “The goal was to develop a bankruptcy court that I always wanted when I practiced law. It is about the case and not about the judge. And to have a bankruptcy court that is accessible and predictable.”

Industry analysts said that the bankruptcies are going to keep coming well past the point when a vaccine for COVID-19 is found.

Jeff Prostok, a Fort Worth bankruptcy lawyer with the firm Forsey Prostok, said that the bankruptcies already filed have been enormous. The reason many companies are holding off going to court is the lack of funding to exit bankruptcy in a financially health position.

“There is so much uncertainty,” Prostok said. “How do you reorganize or restructure if you don’t know what your revenue stream is going to be for the year ahead. There is no way to project.

“What is a bank going to do with a hotel that specializes in big events?” he continued. “Landlords don’t have a lot of options. They don’t have future tenants standing in line right now to sign new lease agreements.”

Alfredo Perez, a bankruptcy and restructuring partner at Weil, Gotshal & Manges in Houston, agrees.

“It is virtually impossible to make many predictions because this situation is novel,” said Perez, who is advising CEC Entertainment (Chuck E. Cheese) and NPC International in their respective restructurings. “Let’s look six months from now and we will know much more.

“There is going to be more economic fallout that we cannot even predict at this time,” he said. “I wonder if there are entire business models that are going to be significantly impacted by the pandemic.”

Why Houston?

Perez said the hard work of Chief Judge Jones and fellow bankruptcy judge Marvin Isgur is the reason the Southern District is now one of the favored courts in the U.S. for large corporate restructurings.

“Both judges have strong business and energy industry backgrounds, and they understand how businesses operate,” Perez said.

The bankruptcy judges in the Southern District, led by Chief Judge Jones, issued new rules and procedures in 2015 for complex corporate restructurings that nearly all experts believe are more accessible and predictable for the debtors.

It worked.

The 602 corporate bankruptcy filings in the Southern District is nearly three times as much as filed in the three other Texas districts combined. Even so, SDTX actually ranks second in total business bankruptcies filed in the U.S. so far in 2020, according to the Androvett data.

Delaware, which is where so many businesses across the U.S. are officially incorporated, ranks No. 1 with 787 Chapter 11 filings so far this year. The Southern District of New York is third with 456 corporate restructurings during the first half of 2020.

Bankruptcy lawyers roundly praise the judges in the SDTX for their expertise and hard work. But many lawyers wonder how many more mega-complex business reorganizations the district can handle before it is overloaded.

“These two judges are incredible, but they are handling such a large number of cases,” Winikka said. “If the rate of increase continues at this pace, there is going to be a backlog. It is going to be an issue.”

In his interview with The Lawbook, Chief Judge Jones said there is no reason for concern at this point.

“I don’t know how close we are to capacity,” Chief Judge Jones said. “We have not pushed our limits at all so far. Whether it takes 10 or 20 more cases each for us to reach our limit, I just don’t know.”

The article can be accessed in full here.